All Categories

Featured

Table of Contents

It can be uneasy to assume concerning the expenses that are left when we pass away. Failing to intend in advance for an expenditure might leave your household owing countless bucks. Oxford Life's Guarantee final expenditure whole life insurance plan is an economical means to help cover funeral prices and various other expenditures left.

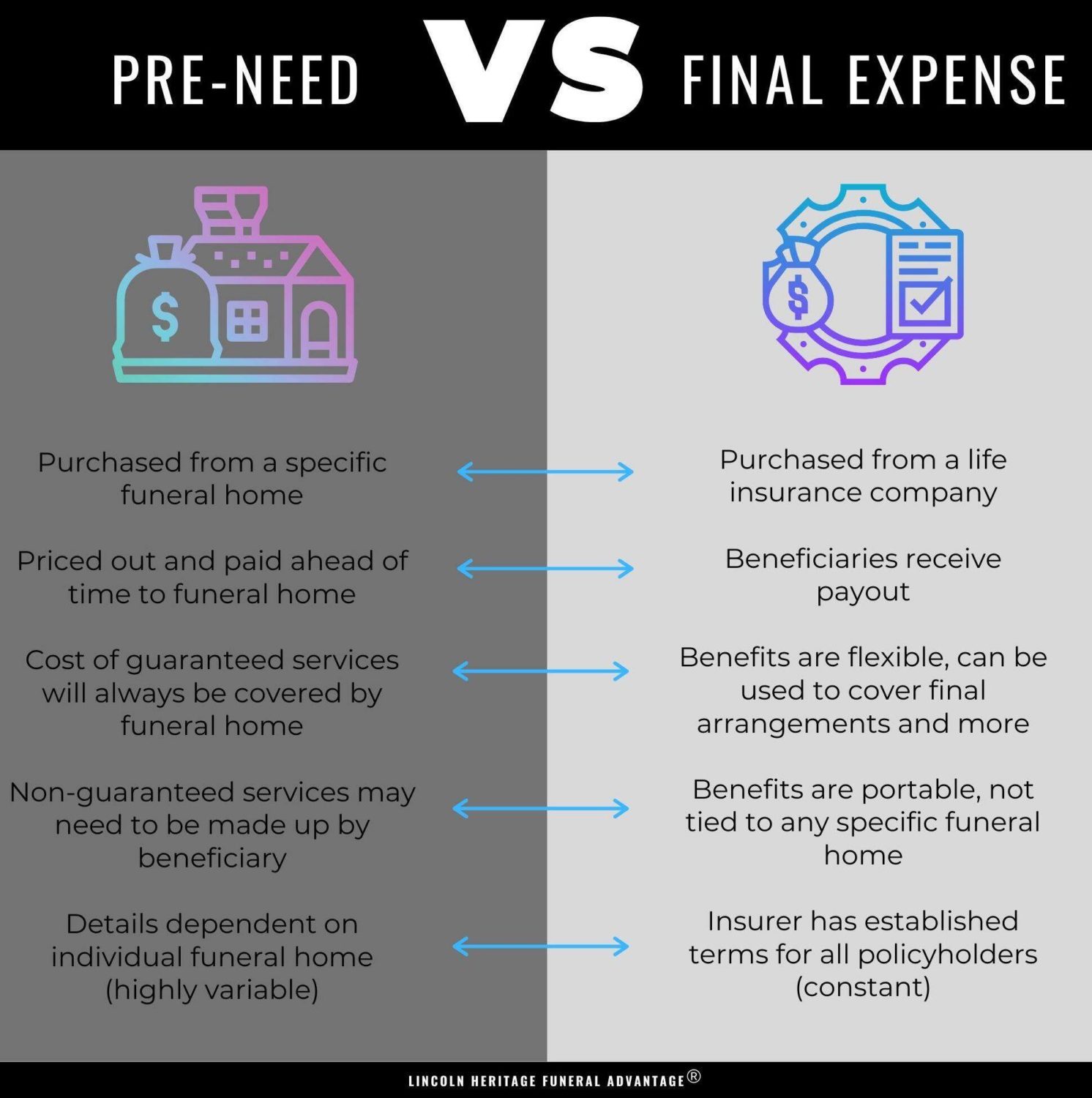

If you make a decision to buy a pre-need plan, be sure and compare the General Rate List (GPL) of several funeral homes before deciding who to acquire the plan from. Right here are some concerns the FTC encourages you to ask when thinking about pre-paying for funeral solutions, according to its brochure, Shopping for Funeral Services: What exactly is consisted of in the expense? Does the expense cover just product, like a casket or container, or does it include various other funeral services?

Burial Insurance Policy

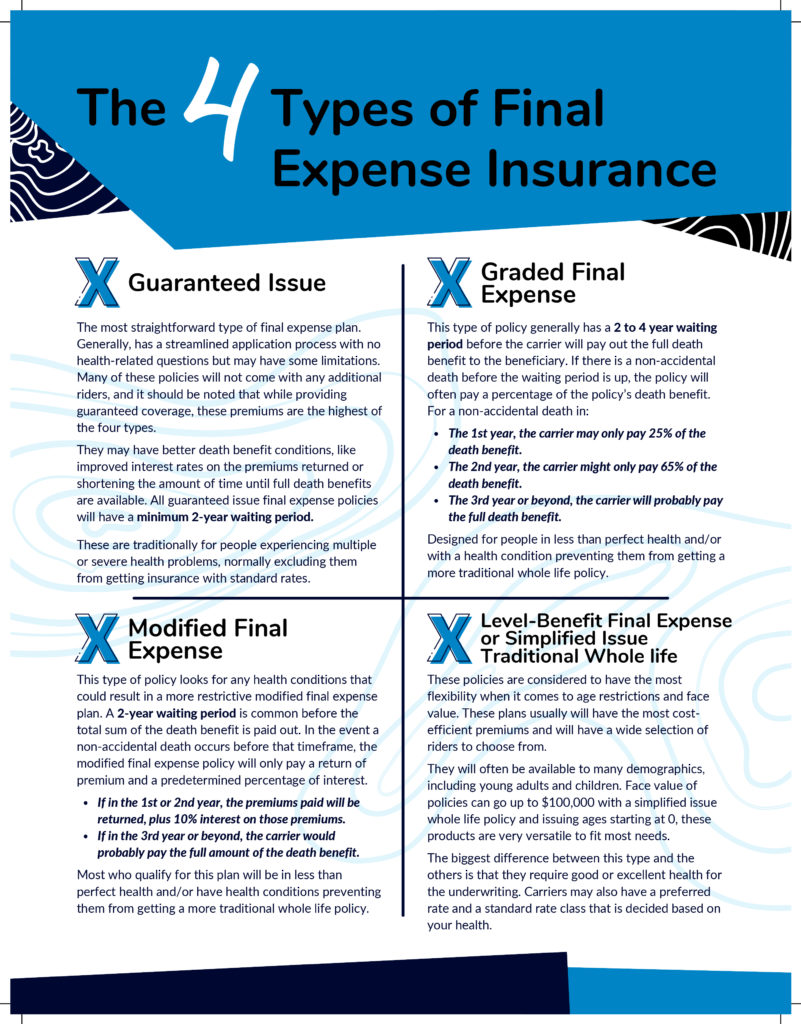

Depending on what you desire to secure, some final expense plans may be better for you than others. In general, a lot of last cost insurance policy business just give a fatality advantage to your recipient.

It's common to presume your family will utilize your life insurance policy advantages to pay for your funeral service costsand they might. But those benefits are implied to change lost revenue and help your family members repay debtso they might or might not be used for your funeraland there can be various other problems, too.

If the insurance policy has not been used and a benefit has actually not been paid during that time, you might have a choice to renew it, but often at a higher costs price. This sort of plan does not secure versus rising funeral costs. In some cases called permanent insurance, this has a greater costs due to the fact that the benefit does not expire in a specific period.

These plans stay in force up until the moment of fatality, at which aim the advantage is paid completely to the marked beneficiary (funeral home or individual). If you are in healthiness or have just minor health and wellness problems, you might consider a medically underwritten policy. There is normally a thorough case history connected with these plans, but they offer the opportunity for a greater optimum advantage.

Final Expense Insurance Rates

If prices boost and end up being better than the plan's fatality advantage, your household will need to pay the distinction. A plan may have a combination of these components. For some people, a clinical examination is a fantastic obstacle to acquiring entire life insurance.

Medicare only covers clinically needed expenses that are required for medical diagnosis and therapy of an ailment or problem. Funeral prices are not considered medically required and as a result aren't covered by Medicare. Final expenditure insurance offers a simple and fairly inexpensive way to cover these costs, with policy benefits varying from $5,000 to $20,000 or more.

Best Funeral Plans For Over 50s

Purchasing this protection is another means to help plan for the future. Life insurance policy can take weeks or months to pay out, while funeral expenditures can begin adding up instantly. Although the recipient has last word over exactly how the cash is used, these policies do explain the insurance holder's intent that the funds be used for funeral service and associated prices.

While you might not take pleasure in considering it, have you ever took into consideration just how you will alleviate the financial problem on your loved ones after you're gone? is a normally affordable opportunity you might intend to take into consideration. We comprehend that with many insurance coverage alternatives available, recognizing the various kinds can feel overwhelming.

Unexpected fatality advantage: Offers an extra advantage if the policyholder passes away because of a mishap within a given period. Sped up survivor benefit: Gives a portion (or all) of the fatality benefit straight to the guaranteed when they are identified with a certifying incurable ailment. The amount paid will certainly decrease the payout the beneficiaries receive after the insured passes away.

5 Important truths to bear in mind Planning for end of life is never pleasant. Yet neither is the idea of leaving loved ones with unexpected expenditures or financial debts after you're gone. In numerous instances, these economic responsibilities can stand up the settling of your estate. Think about these five truths regarding last costs and just how life insurance policy can assist spend for them.

Coffins and cemetery stories are simply the start. Ceremony charges, transport, headstones, also clergy contributions In 2023, the National Funeral Directors Organization calculated that the regular price of a funeral was $9,995.1 Funerals may be one of the most top-of-mind last expense, yet often times, they're not the just one. Family energy costs and exceptional automobile or home mortgage might need to be paid.

You might have created a will certainly or estate strategy without considering last expenditure prices. Only now is it emerging that final expenditures can require a whole lot economically from liked ones. A life insurance policy may make sense and the money advantage your beneficiary gets can assist cover some financial expenses left such as on a daily basis expenses or perhaps estate tax obligations.

Compare Funeral Covers

Your acceptance is based on health and wellness info you provide or give a life insurance policy firm permission to get. This post is supplied by New York Life Insurance coverage Firm for educational purposes only.

Having life insurance coverage offers you tranquility of mind that you're financially shielding the ones that matter a lot of. One more considerable method life insurance assists your loved ones is by paying for final expenses, such as funeral expenses.

Final expenses are the costs connected with interment home charges, funeral and cemetery fees essentially any of the costs connected with your death. The ideal means to answer this concern is by asking yourself if your liked ones can afford to spend for last expenditures, if you were to pass away, out of pocket.

You may additionally be able to choose a funeral home as your beneficiary for your final expenditures. This option has a number of advantages, including preserving the right to choose where your service will certainly be held.

Talk with your American Family Insurance Policy representative to prepare in advance and ensure you have the best life insurance protection to secure what issues most.

Insurance For Funeral Directors

Passion will certainly be paid from the day of death to day of settlement. If death is because of all-natural reasons, death earnings will certainly be the return of costs, and passion on the premium paid will be at an annual reliable rate specified in the plan agreement. This policy does not guarantee that its proceeds will be sufficient to spend for any kind of certain service or merchandise at the time of need or that services or merchandise will be offered by any type of certain supplier.

A total statement of insurance coverage is discovered just in the policy. For more information on coverage, expenses, limitations; or to apply for protection, call a regional State Farm agent. There are limitations and problems pertaining to settlement of benefits as a result of misstatements on the application. Returns are a return of costs and are based upon the actual death, cost, and financial investment experience of the Firm.

Permanent life insurance policy develops money worth that can be borrowed. Plan loans accumulate rate of interest and unpaid plan lendings and rate of interest will decrease the survivor benefit and money value of the plan. The amount of money worth readily available will generally rely on the type of permanent policy acquired, the amount of protection acquired, the size of time the policy has actually been in pressure and any kind of impressive policy loans.

Table of Contents

Latest Posts

Instant Life Funeral Cover

Final Expense Protection

Funeral Coverage

More

Latest Posts

Instant Life Funeral Cover

Final Expense Protection

Funeral Coverage